Chartered Accountancy CA

CA Foundation | CA Intermediate | CA Final

Are you aspiring to become a Chartered Accountant (CA)? Embarking on the journey to become a CA necessitates dedication, perseverance, and quality education. Moreover, selecting the appropriate CA Foundation classes and courses plays a crucial role in determining your success. We’ll explore CA Foundation, Intermediate, and Final classes, uncovering their numerous benefits in this comprehensive guide. Whether you’re a beginner or experienced, gain valuable insights on CA Foundation classes. Make informed decisions with this comprehensive guide.

What is a Chartered Accountant?

In the realm of finance and accounting, the esteemed position of a Chartered Accountant (CA) is widely recognized and in-demand. Moreover, with extensive training and specialized expertise, CAs are capable of handling intricate financial affairs, taxation matters, auditing procedures, and providing valuable business advisory services. Additionally, the CA Course is structured into three levels and includes a three-year practical training component, spanning approximately 4.5 years in total. Furthermore, pursuing a career as a CA offers promising prospects for professional growth and advancement, regardless of your educational background.

The journey to becoming a CA involves essential stages: CA Foundation, CA Intermediate, and CA Final exams. At each stage, meticulous preparation and a comprehensive grasp of the subjects are imperative. Moreover, in this pursuit, CA Foundation online classes, CA Intermediate classes, and CA Final online classes emerge as invaluable resources. These classes provide a well-structured approach, esteemed faculty, and engaging learning platforms. Additionally, classes not only provide the flexibility and convenience of online study but also equip aspiring CAs with the necessary knowledge and skills to excel in the arduous examinations and embark on a rewarding career as a Chartered Accountant.

With comprehensive course materials, interactive learning tools, and dedicated faculty, these classes ensure students are well-prepared for each level’s challenges. Additionally, the seamless transition between levels and cohesive curriculum allows students to build on foundational knowledge and explore advanced concepts progressively.

The following are the top positions held by a CA:

- Tax Accountant

- Management Accountant

- Financial Accountant

- Financial Analyst

- Budget Analyst

- Auditor, and more

Understanding the Role of ICAI in CA.

The Institute of Chartered Accountants of India (ICAI) is not only responsible for setting the CA curriculum and conducting examinations. But also plays a significant role in providing guidance and support to aspiring CAs. Firstly, it offers various initiatives and programs aimed at enhancing the quality of CA education. One such initiative is the availability of ICAI online classes. These classes provide students with access to expert faculty members and comprehensive study materials in a virtual learning environment. Furthermore, these online classes offer the convenience of learning from anywhere. Allowing students to overcome geographical barriers and access the best classes for CA education.

In addition to ICAI online classes, there are other renowned CA online classes available. These classes incorporate interactive features, live doubt-solving sessions, and mock tests to ensure a well-rounded preparation for CA exams. By leveraging the resources and support provided by ICAI and choosing the best CA online classes, aspiring CAs can receive high-quality education and guidance to excel in their journey towards becoming a Chartered Accountant. Moreover, with their flexible schedules and user-friendly platforms, these online classes offer students a seamless learning experience.

If you're a high school graduate aspiring to pursue a CA course, here are the optimized steps to follow:

- Begin your CA journey through the CA Foundation Course: Once you pass Class 12, you can enroll in the CA Foundation Course. This course serves as the first step in becoming a Chartered Accountant, providing you with a strong foundation of knowledge and skills.

- Qualify for CA Intermediate Classes: After successfully completing the CA Foundation Course, you can proceed to register for the CA Intermediate Classes. This stage further builds upon the foundational knowledge gained in the previous course and delves into more advanced topics.

- Join a Three-Year Articleship: Upon clearing the first group of CA Intermediate Classes, you are required to undertake a three-year Articleship. This period serves as a valuable internship where you gain practical experience and apply the theoretical concepts you have learned. It provides hands-on training in various domains, such as auditing, taxation, and accounting.

- Enroll in CA Final Online Classes: After completing the Articleship and qualifying the CA Intermediate, you can register for the CA Final Online Classes. This is the last stage of the CA course, where you consolidate your knowledge and prepare for the final examinations. The CA Final Online Classes offer a flexible and convenient mode of learning, allowing you to access expert guidance and study materials to enhance your chances of success.

Az online kaszinók revolut lehetőségeiről bővebb információkat kaphatsz a KaszinoHungary10 partnerségével.

By following these optimized steps—starting with the CA Foundation Course, progressing to CA Intermediate Classes, completing a three-year Articleship, and finally enrolling in CA Final Online Classes—you can navigate your way towards becoming a qualified Chartered Accountant.Prozkoumejte širokou škálu her a sázek v online kasinu 22bet casino s našimi partnery, recenzním portálem KasinoCzech10.

Levels of CA - CA Foundation Classes, CA Intermediate Classes, & CA Final Online Classes:

Duration of the CA Course

Embarking on the journey to become a Chartered Accountant (CA) involves progressing through different levels of education and examinations. Let’s explore each level in detail:

CA Foundation Level: Building a Strong Foundation

The CA Foundation level plays a crucial role in establishing a strong foundation for a successful CA career. Firstly, it equips aspiring CAs with essential knowledge in subjects such as Accounting, Economics, Business Laws, and Business Mathematics. Moreover, enrolling in CA Foundation Classes provides students with comprehensive guidance and study materials, enabling them to grasp core concepts effectively. Furthermore, through CA Foundation Online Classes or CA Foundation Pendrive Classes, students can choose flexible learning options that suit their preferences and schedules. Additionally, these classes offer the convenience of accessing course materials anytime, anywhere. Besides, seeking CA Foundation Coaching further enhances understanding and increases the chances of success. With a solid foundation established through rigorous preparation, students are well-prepared to advance to the next level of their CA journey.

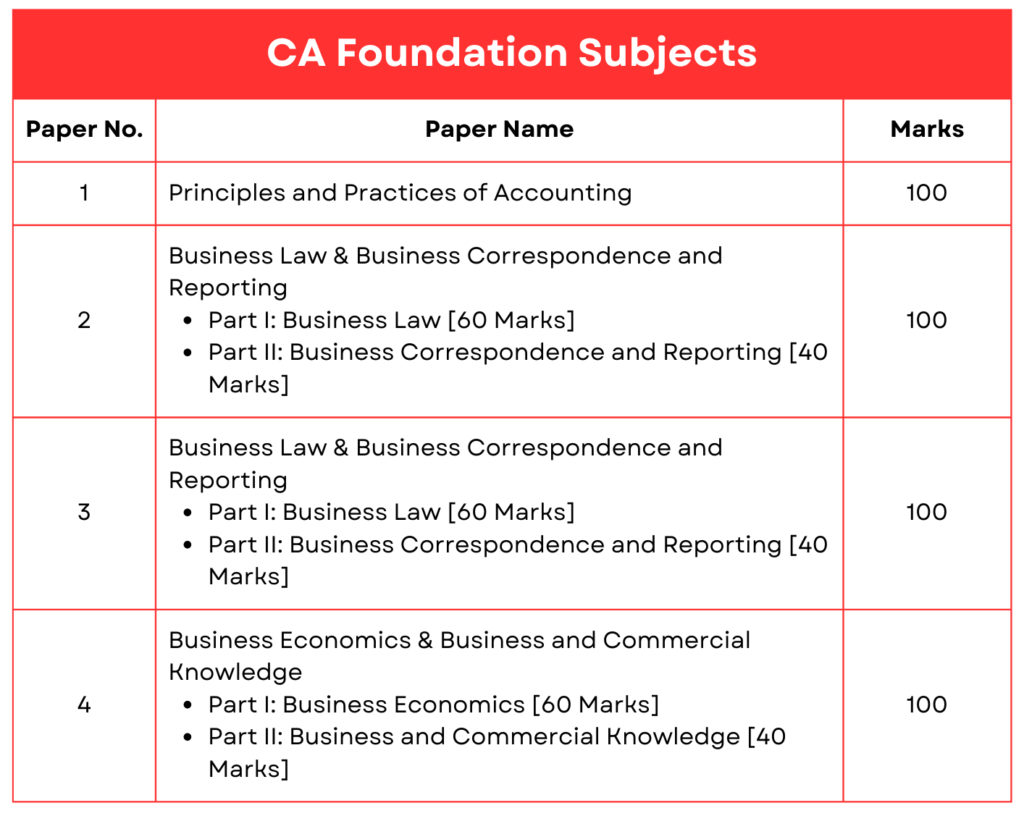

To summarize, the CA Foundation level offers a comprehensive curriculum, various learning options such as CA Foundation Classes, CA Foundation Online Classes, CA Foundation Pendrive Classes, and CA Foundation Coaching. Additionally, the four papers in the CA Foundation examination assess students’ knowledge and proficiency in different subject areas, ensuring they possess the necessary skills to excel in their CA career.

CA Intermediate Level: Advancing Your Knowledge

CA Final Level: The Ultimate Challenge

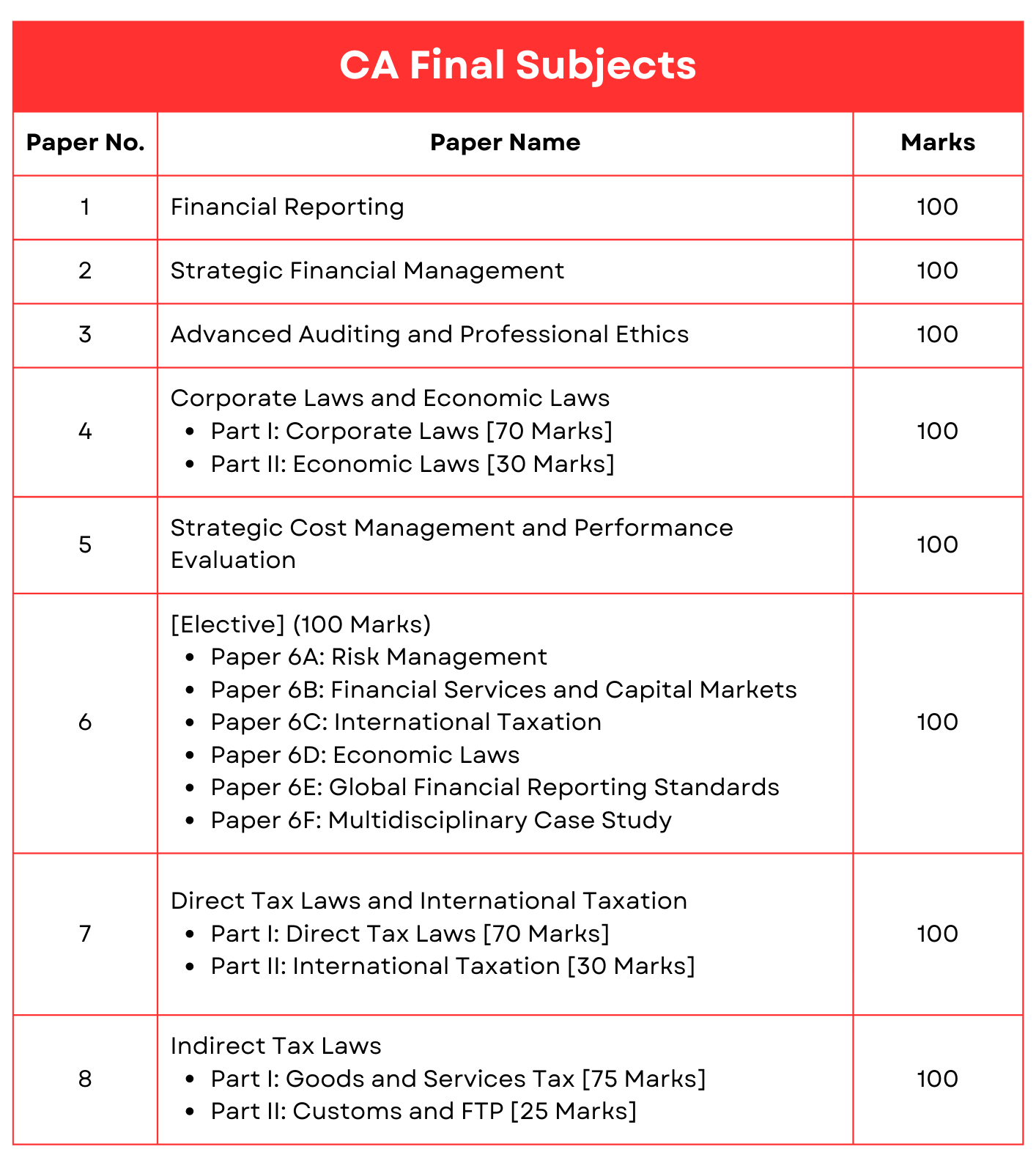

The CA Final level represents the pinnacle of the CA course and the ultimate challenge. It focuses on advanced topics such as Financial Reporting, Strategic Financial Management, Advanced Auditing and Professional Ethics, and Corporate and Economic Laws. CA Final Online Classes play a pivotal role in providing comprehensive guidance and expert insights to students, preparing them effectively for the CA Final exams. These online classes, along with CA Online Classes, are recognized as some of the best classes for CA students. Leveraging the resources provided by ICAI Online Classes and other reputable institutions ensures students receive high-quality education and preparation. With dedication, perseverance, and the right guidance, aspiring CAs can conquer the challenges of the CA Final level and emerge as successful Chartered Accountants.

Preparing for the CA Final level requires students to delve deep into the intricacies of financial reporting, strategic financial management, auditing and ethics, and corporate and economic laws. The curriculum covers complex topics and necessitates a comprehensive understanding of accounting principles, financial analysis, legal frameworks, and ethical considerations. Students pursuing the CA Final level are encouraged to join CA Final Online Classes and CA Online Classes to benefit from the expertise of experienced faculty members. These classes offer a structured approach to studying and provide valuable insights, tips, and techniques to tackle the demanding CA Final exams.

CA Final Online Classes offer flexible learning options, allowing students to access lectures, study materials, and practice questions at their convenience. These classes utilize advanced teaching methodologies and interactive platforms to enhance student engagement and comprehension. By enrolling in these classes, students can gain a deeper understanding of the complex concepts and practical applications required at the CA Final level.

The CA course is a rigorous program that requires a significant time commitment from aspiring Chartered Accountants. The duration of the CA course varies depending on the level and the pace at which students progress through each stage.

CA Foundation Level:

The initial step of the CA course is the CA Foundation level. The duration of this level is approximately four months. During this time, students undergo intensive preparation through various resources. CA Foundation Pendrive Classes provide comprehensive guidance and study materials to help students grasp the foundational concepts effectively.

CA Intermediate Level:

Upon successful completion of the CA Foundation level, students progress to the CA Intermediate level. The duration of this level is approximately eight months. This stage focuses on advanced subjects and in-depth practical knowledge. Students are required to undergo a three-year Articleship after qualifying the first group of CA Intermediate Classes. This practical training period provides valuable real-world experience in the field of accounting and finance

CA Final Level:

The final stage of the CA course is the CA Final level. The duration of this level is approximately six months. At this stage, students consolidate their knowledge and skills through specialized subjects and advanced topics. CA Final Online Classes and other resources are instrumental in providing comprehensive guidance and expert insights to students.

Overall, the duration of the complete CA course, from the CA Foundation level to the CA Final level, can range from three to five years, considering the time required for completing the Articleship and clearing the examinations at each level. It is important for aspiring CAs to understand and plan for the duration of the course, considering their personal commitments and dedication required for successful completion.

Know everything about CA Course in the video

Syllabus of CA

Each level has a comprehensive syllabus designed to equip aspiring Chartered Accountants with the necessary knowledge and skills. Let’s take a closer look at the syllabus of each level:

CA Foundation Level:

At the CA Foundation level, students are introduced to fundamental concepts in subjects such as Accounting, Business Laws, Business Mathematics, and Economics. Moreover, the syllabus covers topics that lay a strong foundation for future studies in the field of Chartered Accountancy. Additionally, CA Foundation Classes, including CA Foundation Online Classes, CA Foundation Pendrive Classes, and CA Foundation Coaching, provide students with the necessary guidance and study materials to understand these subjects effectively.

Download CA Foundation complete syllabusClick Here

CA Intermediate Level

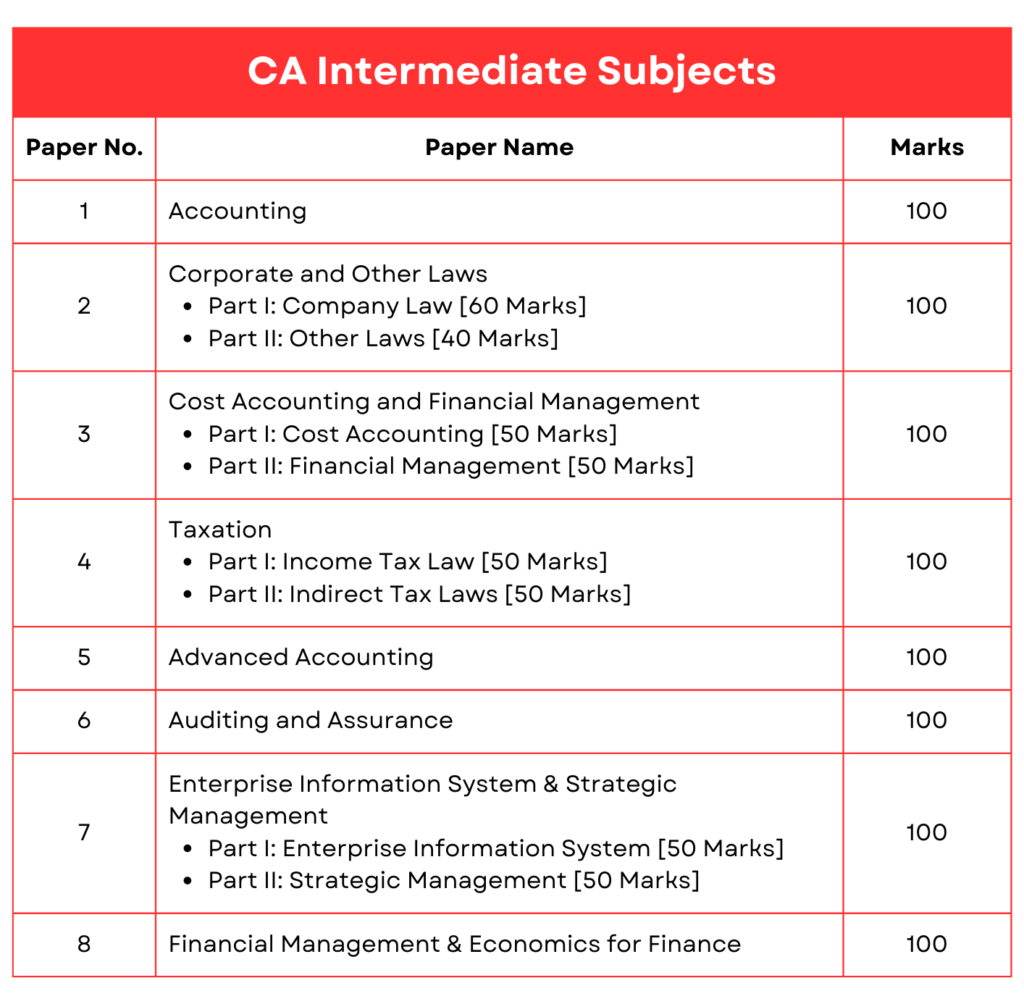

The CA Intermediate level builds upon the knowledge acquired in the CA Foundation level. Additionally, it covers subjects that delve deeper into accounting, taxation, auditing, and corporate laws. Moreover, the syllabus focuses on developing a comprehensive understanding of these areas and their practical application. Furthermore, CA Intermediate Classes, such as CA Intermediate Classes and CA Inter Classes, are available to help students grasp the concepts and excel in their studies.

Download CA Intermediate complete syllabusClick Here

CA Final Level:

The CA Final level is the last stage of the CA course and emphasizes advanced concepts and specialized areas of accounting, finance, and law. The syllabus includes subjects like Financial Reporting, Strategic Financial Management, Auditing and Assurance, and Corporate Laws. CA Final Online Classes, CA Online Classes, and ICAI Online Classes offer comprehensive guidance to students, helping them navigate through the complex topics covered in the syllabus.

Understanding the syllabus of each level is crucial for CA aspirants as it enables them to plan their studies effectively and focus on the specific areas of knowledge required at each stage. By enrolling in appropriate classes, such as CA Foundation Classes, CA Intermediate Classes, and CA Final Online Classes, students can enhance their understanding of the syllabus and maximize their chances of success in the CA examinations.

Download CA Final complete syllabusClick Here

CA Course Subjects

The CA course encompasses a wide range of subjects that equip aspiring Chartered Accountants. With the knowledge and skills necessary for a successful career in accounting, finance, and business. Additionally, from the foundational level to the advanced stages, each level of the CA course introduces students to different subjects and builds upon their understanding and expertise. Now, let’s delve into the subjects covered in each level:

CA Foundation Subjects

At the CA Foundation level, students are introduced to the fundamentals of accounting and business. The subjects included in this level are:

CA Foundation Video Lectures, CA Foundation Pendrive Classes, CA Foundation Google Drive Class, CA Foundation Online Class, Best Video Classes for CA Foundation by India’s Top Faculties at very economical fee.

CA Intermediate Subjects

After completing the CA Foundation level, students progress to the CA Intermediate level, where they delve deeper into various subjects. The subjects covered in this level include:

CA Intermediate Video Lectures, CA Intermediate Pendrive Classes, CA Intermediate Google Drive Class, CA Intermediate Online Class, Best Video Classes for CA Intermediate by India’s Top Faculties at very economical fee.

CA Final Subjects

The CA Final level represents the pinnacle of the CA course, where students face the ultimate challenge in their journey to becoming Chartered Accountants. The subjects covered at this level include:

CA Final Video Lectures, CA Final Pendrive Classes, CA Final Google Drive Class, CA Final Online Class, Best Video Classes for CA Final by India’s Top Faculties at very economical fee.

-

Paper 1 – Financial Reporting (CA Final Group I New Syllabus) by CA Parveen Sharma

₹14,900.00 – ₹20,000.00

ICAI Study Material

The Institute of Chartered Accountants of India (ICAI) provides study material that serves as a comprehensive resource for students pursuing the CA course. Moreover, the study material is designed to cover the entire syllabus of each level, including CA Foundation, CA Intermediate, and CA Final, and plays a crucial role in exam preparation. Now, let’s delve into the level-wise study material offered by ICAI:

CA Foundation Study Material:

For students at the CA Foundation level, ICAI offers well-structured study material that covers all the subjects included in the syllabus. The study material includes textbooks, practice manuals, and supplementary materials that provide in-depth coverage of topics. Such as Principles and Practices of Accounting, Business Laws and Business Correspondence, Business Mathematics and Logical Reasoning, and Business Economics and Business Commercial Knowledge. By utilizing the CA Foundation study material, students gain a comprehensive understanding of the subjects and can effectively prepare.

Download CA Foundation Study MaterialClick Here

CA Intermediate Study Material:

At CA Intermediate level, provided study material helps students build upon their foundational knowledge and delve deeper into the subjects. The study material for CA Intermediate includes textbooks, practice manuals, and supplementary materials for each subject, covering areas such as Accounting, Corporate and Other Laws, Cost and Management Accounting, Advanced Accounting, Auditing and Assurance, and Enterprise Information Systems and Strategic Management. The CA Intermediate study material allows for strengthening conceptual understanding, practicing problem-solving, and thorough exam preparation.

Download CA Intermediate Study MaterialClick Here

CA Final Study Material:

The study material provided by ICAI, indeed, caters to the advanced requirements of students at the CA Final level. Additionally, the study material encompasses textbooks, practice manuals, and supplementary materials covering subjects such as Financial Reporting, Strategic Financial Management, Advanced Auditing and Professional Ethics, Corporate and Economic Laws, Strategic Cost Management and Performance Evaluation, and elective papers. Notably, a comprehensive understanding of advanced concepts is fostered through the in-depth coverage offered by the CA Final study material. Consequently, this ensures that students perform well in the exams.

By utilizing the ICAI study material, students gain access to authoritative content that is meticulously aligned with the CA course curriculum. Moreover, the study material follows a structured and systematic approach to learning, facilitating a step-by-step progression. Additionally, it incorporates practice questions, examples, and case studies to enhance problem-solving skills and promote practical application of knowledge. Furthermore, the ICAI study material, in conjunction with appropriate guidance from CA Foundation Classes, CA Intermediate Classes, or CA Final Online Classes, lays a robust foundation for exam preparation. Consequently, it equips students with the necessary knowledge and skills essential for success in the CA course.

Download CA Final Study MaterialClick Here

Previous Year CA Question Papers

Previous year CA question papers, indeed, serve as highly valuable resources for students at every level of the CA course. Which include CA Foundation, CA Intermediate, and CA Final. These papers, undoubtedly, play a crucial role in exam preparation and offer numerous benefits to aspiring Chartered Accountants. Now, let’s delve into the importance of previous year question papers at each level in detail:

CA Foundation Previous Year Question Papers

For students at the CA Foundation level, the practice of solving previous year question papers offers a multitude of benefits. Firstly, it provides a deeper understanding of the exam pattern, marking scheme, and the types of questions asked. Additionally, by engaging in regular practice with CA Foundation question papers, students can become familiar with the structure of the exams and gain confidence in tackling various topics. Moreover, it enables them to identify their strengths and weaknesses, refine their time management skills, and develop effective exam strategies. Furthermore, CA Foundation Classes, whether in-person or online, play a crucial role in complementing the practice of previous year papers by providing valuable guidance and insights on exam preparation.

Check-out Past Year CA Foundation PapersClick Here

CA Intermediate Previous Year Question Papers

At the CA Intermediate level, the importance of solving previous year question papers becomes even more pronounced. Moreover, these papers serve as a realistic preview of the actual exams, allowing students to accurately assess their level of preparation. Additionally, by engaging in regular practice with CA Intermediate question papers, students can effectively identify the areas that require additional attention and enhance their problem-solving abilities. Furthermore, valuable insights into the application of concepts are obtained through the inclusion of case studies and practical scenarios in previous year papers. Furthermore, to further complement the practice of previous year papers, students can opt to attend CA Intermediate Classes either physically or access them through online platforms, thereby gaining additional support and guidance.

Check-out Past Year CA Intermediate PapersClick Here

CA Final Previous Year Question Papers

Moreover, At the CA Final level, the significance of solving previous year question papers cannot be overstated. These papers familiarize students with the exams’ complexity and depth, aiding success. By engaging in regular practice with CA Final question papers, students refine their understanding of advanced concepts, enhance analytical skills, and develop comprehensive and well-structured answering abilities. Time management during the exam is also improved through solving previous year papers. Expert guidance and insights from CA Final Online Classes, CA Online Classes, and other study resources further support students in their preparation with previous year papers.

Incorporating the practice of previous year CA question papers into their study routine offers students several advantages. It acquaints them with the exam format, enhances understanding of concepts, and improves problem-solving abilities. Regular practice boosts confidence and reduces exam anxiety. Moreover, identifying recurring topics, important chapters, and frequently asked questions enables students to focus their preparation effectively.

Check-out Past Year CA Final PapersClick Here

To maximize benefits of pyp, it is recommended to solve them under exam-like conditions, with time limits, and answer evaluation. By combining the practice of previous year question papers with comprehensive coaching. Such as CA Foundation Classes, CA Intermediate Classes, or CA Final Online Classes, students can enhance their performance. Which will increase their chances of success, and pave the way for a rewarding career as a Chartered Accountant.

ICAI Revision Test Paper

Check Your CA Results

CA Proposed Scheme of Education & Training - Download PPT

Click here