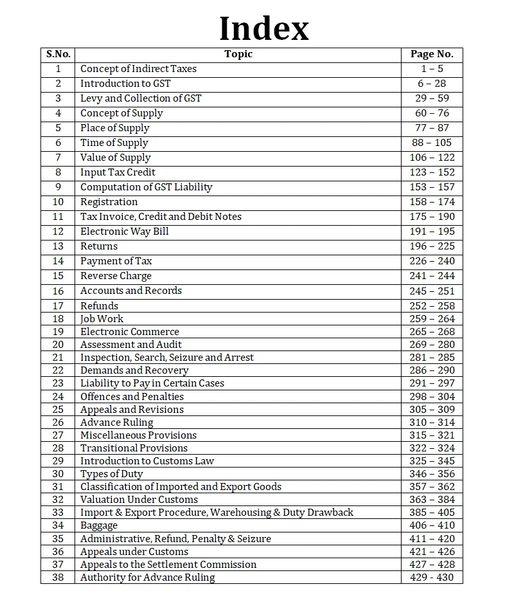

Paper 2A – Advanced Tax Laws – GST, Customs & FTP (CS Professional Module I Old Syllabus) by CA Raj K Agrawal

₹8,000.00 ₹2,000.00

| Program | Pre-Recorded Videos |

|---|---|

| Device | Windows |

| No. of Lecture | 95 |

| Lecture Duration | 76 Hours |

| Language | Hinglish |

| Faculty | |

| Contains | Encrypted Video's, Video Player |

| Usage | Single Device |

| Certificate | No |

1. Classes available for Windows/Android/iOS.

2. You can view it only on any one device.

3. Views allowed are unlimited within the validity period.

4. To view videos on Windows Device, video player provided is required to be installed on your Laptop or Desktop with the help of the tutorial provided. Once installed encrypted videos can be accessed by using “Login ID” sent via email”.

5. On Windows internet is required for 1 or 2 seconds each time when video player is started, post that videos can be viewed offline.

6. On Android and iOS platforms you have the ability to both stream and download videos for offline viewing within the App.

7. If you buy from here you will get access to Windows Device only.

8. Incase you wish to get access on Mobile, buy directly from Android/iOS App – Study At Home – Learning App

Frequently Asked Questions (FAQs):

Q. What is the role of CS in taxation?

A. Company secretaries (CSs) are pivotal in simplifying the complexities of taxation for businesses, acting as essential advisors and intermediaries with tax authorities. Moreover, their expertise encompasses tax registration, compliance, planning, and optimization, ensuring businesses meet obligations and minimize tax burdens. From preparing accurate tax returns to representing companies in disputes and providing updates on evolving tax laws, CSs play a crucial role in navigating the intricate tax landscape. Also, they contribute to effective policy formulation, maintain meticulous tax records, and offer assurance through certifications. In essence, CSs are integral partners, providing valuable support to businesses in understanding, complying with, and optimizing their positions within the tax system. So, enroll in Study At Home CS Professional Advanced Tax Laws Classes for becoming a successful CS.

Q. What is the scope of tax law?

A. Tax law is a broad and complex area of law that encompasses the rules and regulations governing the imposition and collection of taxes. It covers a wide range of topics, including income tax, corporate tax, GST and Customs.

The scope of tax law is constantly evolving as governments and tax authorities seek to adapt to changing economic conditions and new business practices. Tax laws are also subject to judicial interpretation, which can further expand or narrow the scope of the law. To learn CS Professional Advanced Tax Laws, do join this course.

Related

Demo

Related

About Faculty

Highly accomplished and experienced teacher, CA Raj K Agrawal, dedicates himself to helping his students excel in their exams. He prioritizes conceptual understanding and simplifies complex topics with ease, utilizing his expertise in accounting and finance to help countless students achieve academic success. Experience his phenomenal teaching style by enrolling in his CS Professional Paper 2A classes.

Related

2 reviews for Paper 2A – Advanced Tax Laws – GST, Customs & FTP (CS Professional Module I Old Syllabus) by CA Raj K Agrawal

You may also like…

Related products

-

CMA Inter Group I & II – All Subjects Combo

₹94,000.00₹23,500.00

Ranjit –

Thank you sir, for explaining each and every topic in easy and concise manner, this has helped me a lot

Dhruv Mehta –

Hats off to Raj Sir for the ‘Advanced Tax Laws – GST, Customs & FTP’ course, a must-take for CS Professional Module I. Sir ki teaching style bahut acchi hai, samajhne mein aasaan hai. Highly recommend karta hu!