All About CPA US Registration, Classes, Study Material, Fees & Eligibility

What is US CPA?

The American Institute of Certified Public Accountants (AICPA) offers the Certified Public Accountant course (US CPA) as an accounting-related professional course. The flexibility of the US CPA exam, which can be taken from anywhere in India upon completion of the CPA US registration process, has led to a significant increase in the number of candidates pursuing the exam in recent years. The CPA US registration process allows candidates to obtain a globally recognized accounting qualification that is comparable to the Chartered Accountancy (CA) qualification in India. With the US CPA qualification, individuals can unlock new job opportunities in the field of accounting and finance, both in India and around the world.

Unlock your USA CPA dream with our discounted registrationClick Here

Eligibility Criteria for CPA US Registration:

For the purpose of evaluating academic performance and determining who is eligible to sit for the US CPA exam and be licensed, the US uses a credit-based system. In general, 30 US semester credits are equal to one year of university study in India.

Using 30 credits per year,

- B.Com. = 3 years x 30 credits = 90 credits.

- M.Com./MBA + B.Com. = 90 + 60 = 150 credits

- B.Com + CA + CS + CWA = 90 + 60 = 150 credits

CA, CS, and CWA a few states recognize it as 2-3 years of US education.

The minimum education requirement for US CPA EXAM is 120 CREDITS

To be eligible for the CPA license, you need to complete the CPA US registration process, which includes –

- 150 CREDITS – B.Com + CA + CS + CWA = 90 + 60 = 150 credits

- The candidate must have a bachelor’s degree in Commerce/Accounting/Business with any of the below qualifications to have 150 credits

-

- Member of the “Institute of Costs & Works Accountants in India.”

- Member of the “Institute of Chartered Accountants of India.”

- Member of the “Company Secretaries in India.”

- MBA Master of Commerce.

-

- Obtain work experience (2,000 hrs. of work experience)

- Write ETHICS exam

Ready to check your eligibility for the USA CPA exam?Click Here

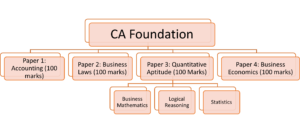

CPA Syllabus:

To become a Certified Public Accountant (CPA) in the United States, individuals must meet specific education and experience requirements and complete the CPA exam. Registration for the CPA exam involves submitting an application and paying an exam fee. The exam consists of four papers, each lasting four hours. Containing a mix of multiple-choice questions, simulations, and written communication tasks. Maintaining active registration as a CPA requires fulfilling ongoing education and professional development requirements, as well as complying with ethical and professional standards set by the American Institute of Certified Public Accountants (AICPA).

- Auditing & Attestation (AUD)

- Business environment and concept (BEC)

- Financial Accounting & Reporting (FAR)

- Regulation (REG)

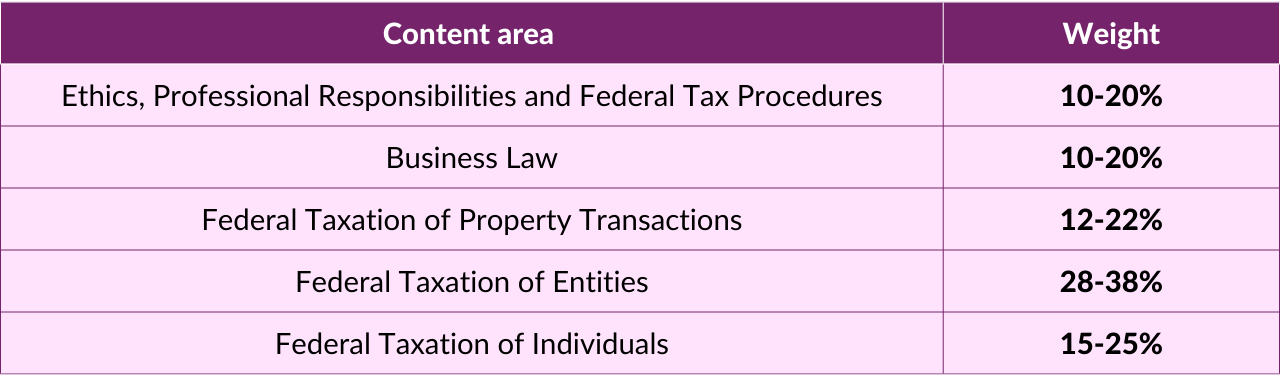

Content distribution in each paper:

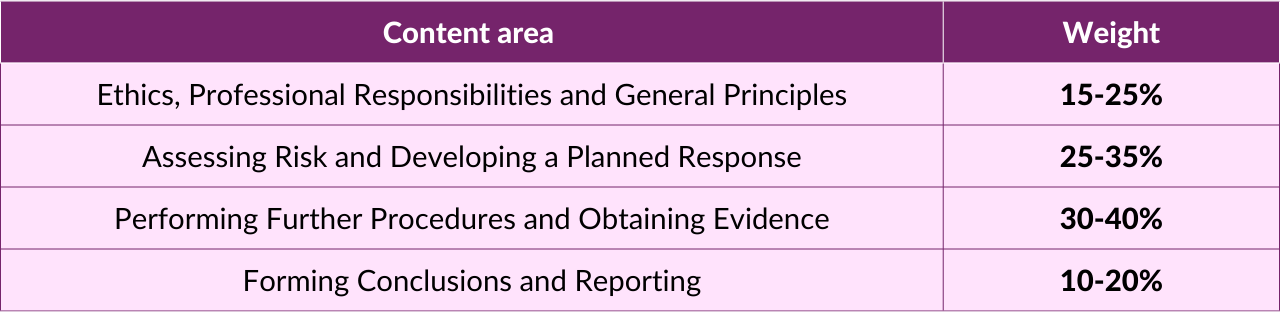

- Auditing and Attestation: The purpose of this paper is to evaluate the student’s abilities to carry out audit engagements, attestation engagements, or accounting and review service engagements. The entire content is divided into four categories, each with a different weight, as follows:

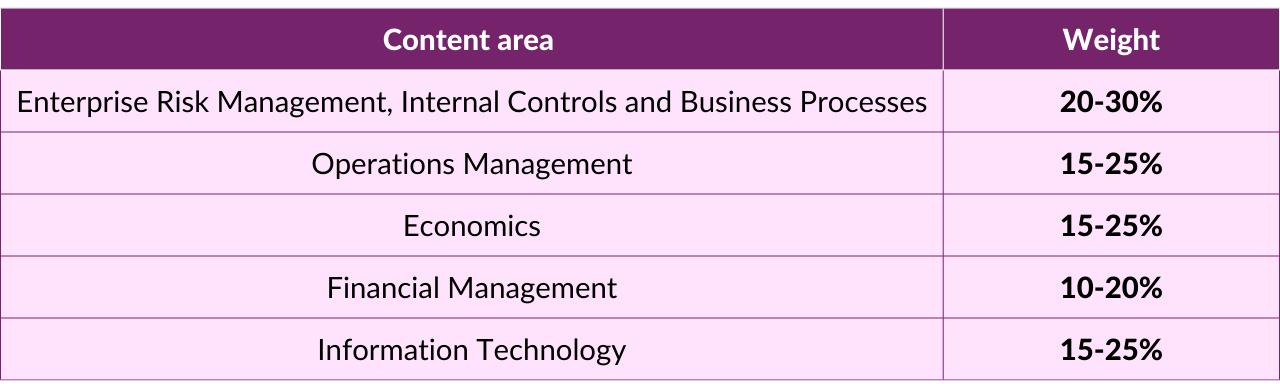

- Business Environment & Concepts: The purpose of this paper is to evaluate your ability to perform professional services such as auditing, attesting, accounting, reviews, financial reporting, and tax preparation. The entire content is divided into four categories, each with a different weight, as follows:

Unlock new job opportunities with the USA CPAClick Here

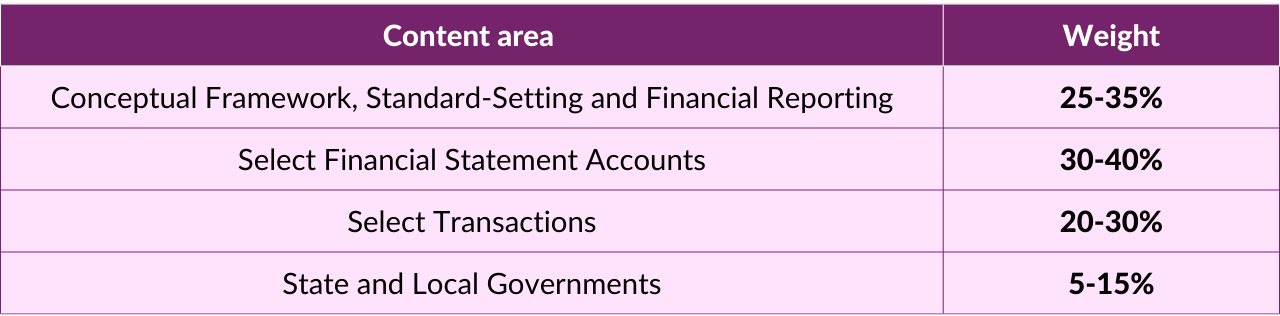

- Financial Accounting & Reporting: The purpose of this paper is to showcase the writer’s knowledge and skills in the financial accounting and reporting frameworks, which various organizations including businesses, governments, and others utilize. The paper is divided into four categories, each carrying a different weight, as follows:

- Regulation: This paper aims to demonstrate abilities and knowledge in the areas of US business law, US ethics and professional responsibilities related to tax practise, and US federal taxation. The entire content is divided into four categories, each with a different weight, as follows:

Study material for USA CPA

US CPA Study Material can help candidates prepare for the CPA exam, and many opt for study materials from trusted providers. Becker Study Material is a popular choice among CPA exam candidates. It costs around 1,25,000 rupees plus 18% GST and includes recorded videos, 6,500 multiple-choice questions (MCQs), and 3,000 simulations (SIMs) to help candidates practice. Meeting the education and experience requirements and registering for the CPA exam in the US is a prerequisites for accessing these study materials. Becoming a CPA involves passing the exam, maintaining active registration, and adhering to ethical and professional standards set by the American Institute of Certified Public Accountants (AICPA).

Get Becker study material at a discounted price for your CPA journey!Click Here

Examination pattern of USA CPA

The CPA exam is divided into several sections, with each section containing smaller segments called tests. The tests include the following:

- Multiple Choice Questions (MCQs): Each exam section’s initial two testlets will cover these..

- Task-Based Simulations (TBS): TBS are presented as case studies, with the AUD, FAR, and REG exam sections each having three TBS testlets, and the BEC section having two.

- Written Communications Tasks: These tasks are only found in the BEC section and would be in the form of memos or letters.

As the CPA exams last four hours each, it is important to get used to sitting still during exams. To do this, it is advisable to take practice exams before taking the main exam. Many candidates opt for US CPA online classes to help them prepare for the exams. As these classes provide access to experienced instructors, study materials, and practice exams to ensure comprehensive preparation. Meeting the education and experience requirements and registering for the CPA exam in the US is a prerequisites for accessing these classes. Becoming a CPA involves passing the exam, maintaining active registration, and adhering to ethical and professional standards set by the American Institute of Certified Public Accountants (AICPA).

The weightage of the multiple-choice questions, task-based Simulations and written communications for each exam is as follows:

- Both multiple-choice questions and task-based simulations have the same weight, but because TBS are case studies, they are ultimately going to take longer than MCQs

- 50% of your points come from MCQs, and the remaining 50% come from task based simulations.

- Only in BEC the TBS hold 35% and written communications task hold other 15%.

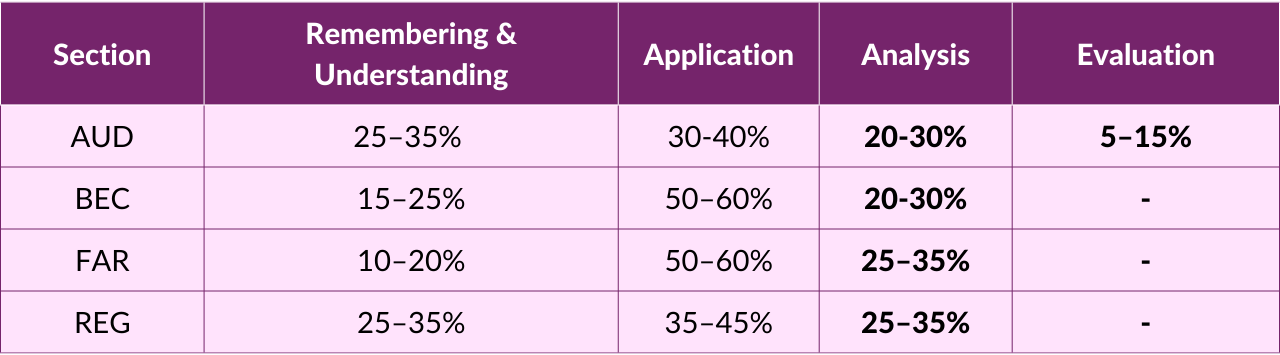

Assessment of Skill Levels in Each Section:

Passing criteria:

To become a Certified Public Accountant (CPA) in the United States, candidates must fulfill specific education and experience requirements and pass the CPA exam. Registering for the CPA US Registration is a prerequisite for taking the exam and working towards passing it. The exam is graded on a scale of 0-99, and in order to pass, a candidate must receive a score of 75 or higher. It is crucial for candidates to understand that the passing score is 75 points, not 75 percent, as many applicants may misunderstand this point. It is also worth noting that the passing percentage of the US CPA exam is approximately 50% globally. Once a candidate passes the exam, they can become an active CPA by complying with ethical and professional standards set by the American Institute of Certified Public Accountants (AICPA) and fulfilling ongoing education and professional development requirements.

Exam Windows:

US CPA classes can help aspiring accountants in India prepare for the CPA exam. Which opens four times a year: January to March, April to June, July to September, and October to December. To take advantage of this opportunity, candidates must schedule their exam at a convenient time and date within the testing window.

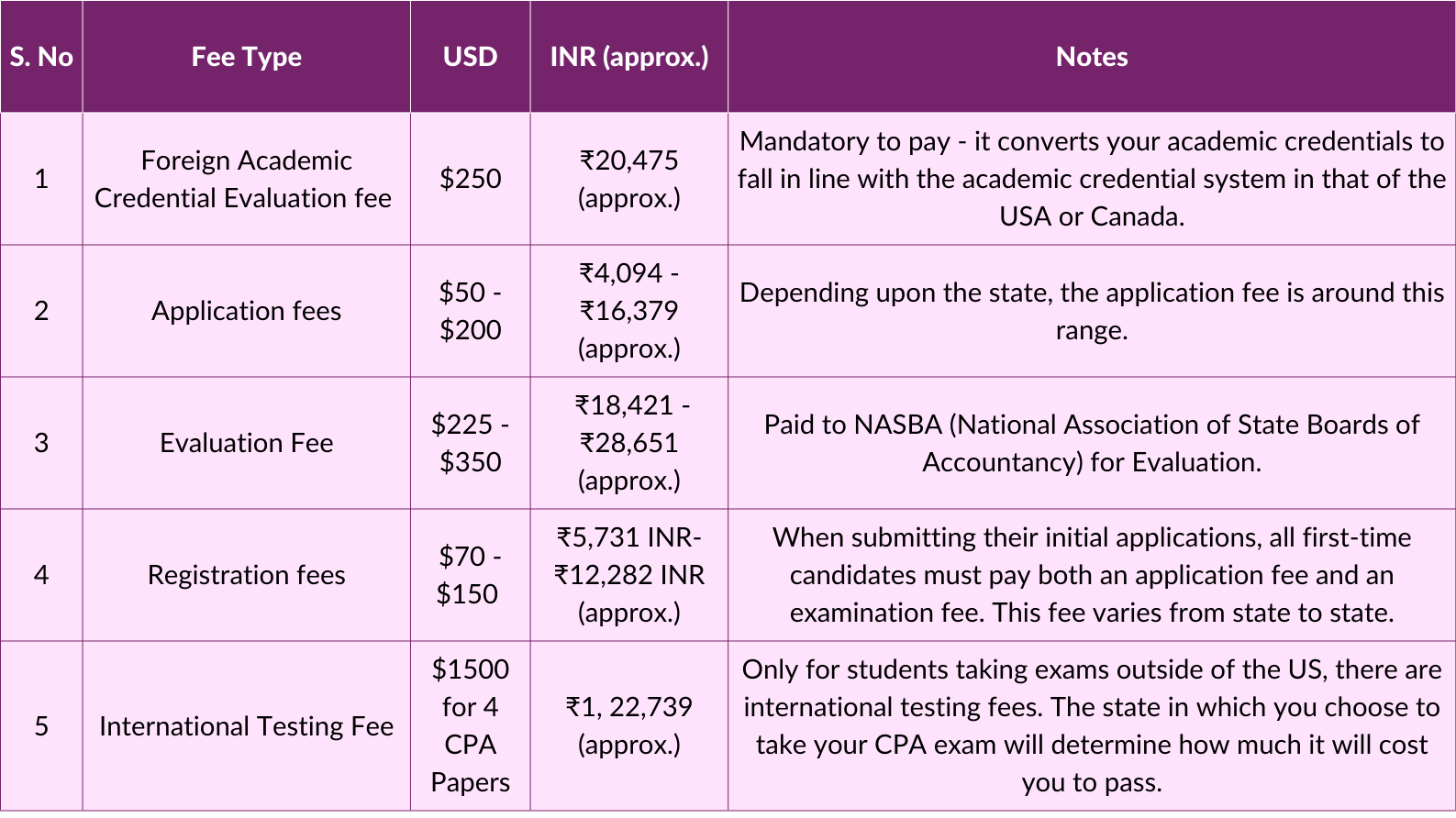

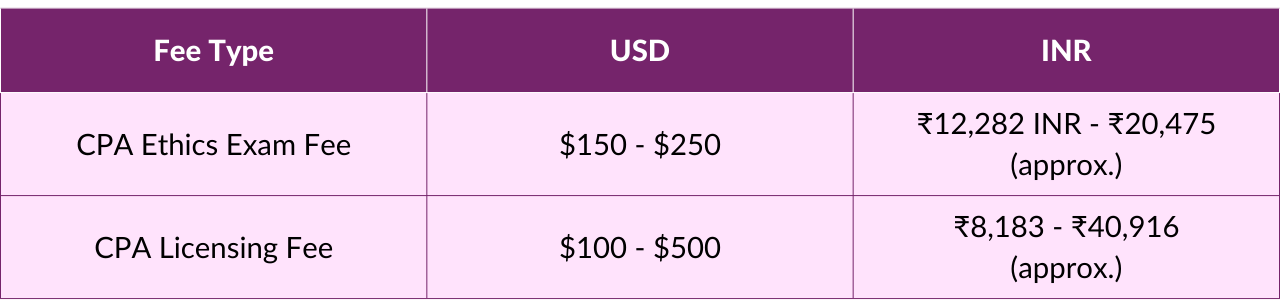

CPA Exam Cost

Those who are interested in becoming a certified public accountant should consider the important factor of the cost of the CPA exam. The US CPA fees can vary depending on the state in which the exam is taken. In addition to the state fees, there are other costs to consider, such as the cost of study materials and preparation courses. For those in India, it’s important to note that the US CPA fees in India may also vary depending on the state and currency exchange rates. However, with the potential for a high salary and opportunities for career advancement, many find that the cost of the exam is worth the investment.

Unlock your USA CPA dream with our discounted registrationClick Here

CPA Exam Rescheduling Fee

Before scheduling your US CPA exam, it’s important to be aware of the fees involved. The fees for the US CPA exam vary depending on the jurisdiction, but the average cost is around $1,500. Additionally, candidates should be aware of the rescheduling fees involved. If you need to reschedule the exam within five to thirty days. A rescheduling fee of $35 must be paid to the Prometric Testing Centre. In India, the cost of the US CPA exam may also vary depending on the exchange rate and local taxes. It’s important to consider all of these fees and costs when preparing for the exam.”

India’s CPA exam centers

For those who plan to take the US CPA exam in India, there are currently eight Prometric test centers available in cities such as –

- Ahmedabad

- Bangalore

- Calcutta

- Chennai

- Hyderabad

- Mumbai

- New Delhi

- Trivandrum

However, before taking the exam, it is important to prepare and review using reliable US CPA study materials. A popular choice among exam candidates is Becker Study Material. They provides recorded videos, 6,500 multiple-choice questions, and 3,000 simulations to help candidates practice. However, it’s worth noting that meeting the education and experience requirements and registering for the CPA exam in the US is a prerequisite for accessing these study materials.

Unlock new job opportunities with the USA CPAClick Here

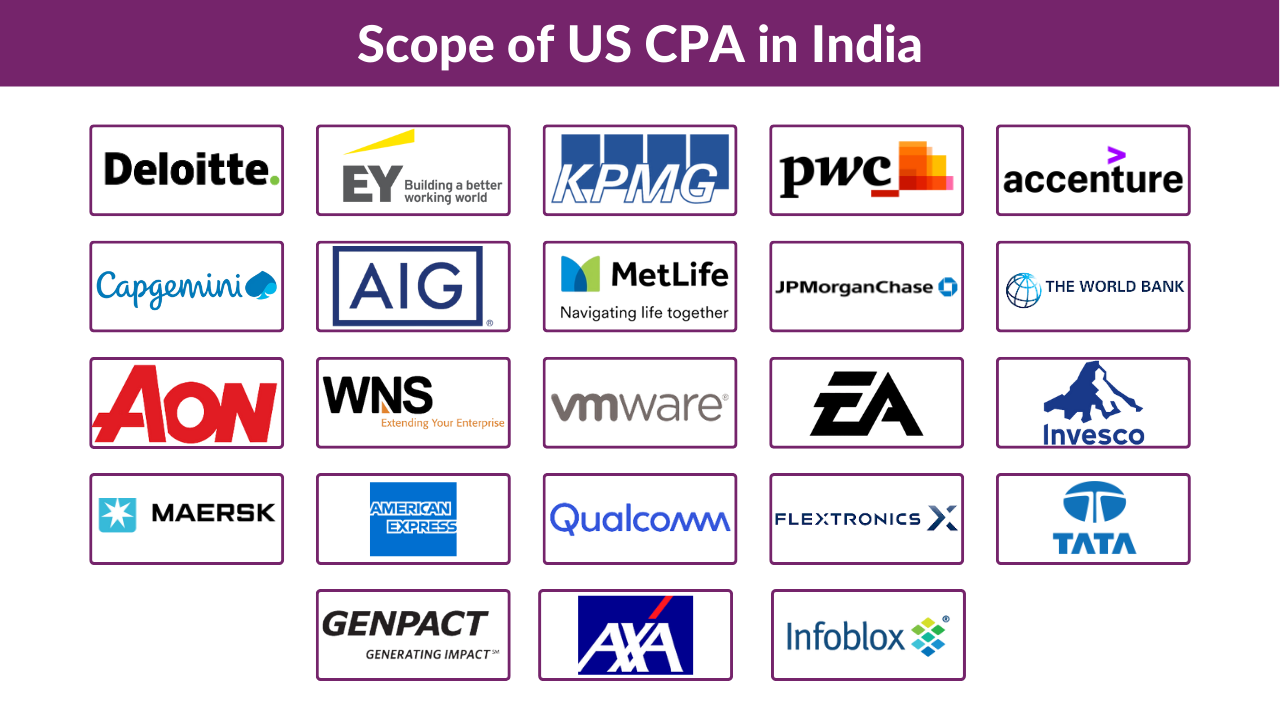

Scope of US CPA in India

CPA US Registration opens up a plethora of job opportunities for CPAs in India. Corporate giants such as Big 4, BCG, Oracle, JPMC, and many others hire CPAs for various job roles. In India, tax auditor, financial analyst, and auditor are the top three roles held by CPAs. But several other roles such as consultant, controller, and finance manager are also available. After gaining experience and skills, CPAs can pursue careers as risk management specialists, financial consultants, strategists, and other similar roles. CPAs in India can live prosperous life. As the average annual compensation for US-certified public accountants in India is close to 10 lakhs rupees per annum.

Here are some tips for successfully passing the CPA exam:

- Create a study plan and stick to it.

- Use multiple study resources, such as textbooks, review courses, and practice exams.

- Take advantage of study groups and tutoring opportunities.

- Practice time management and exam-taking strategies.

- Stay up-to-date on the latest developments in the field.

- Maintain a healthy work-life balance to avoid burnout