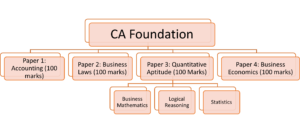

Faircent P2P – Peer to Peer Lending & Better Return on Investing

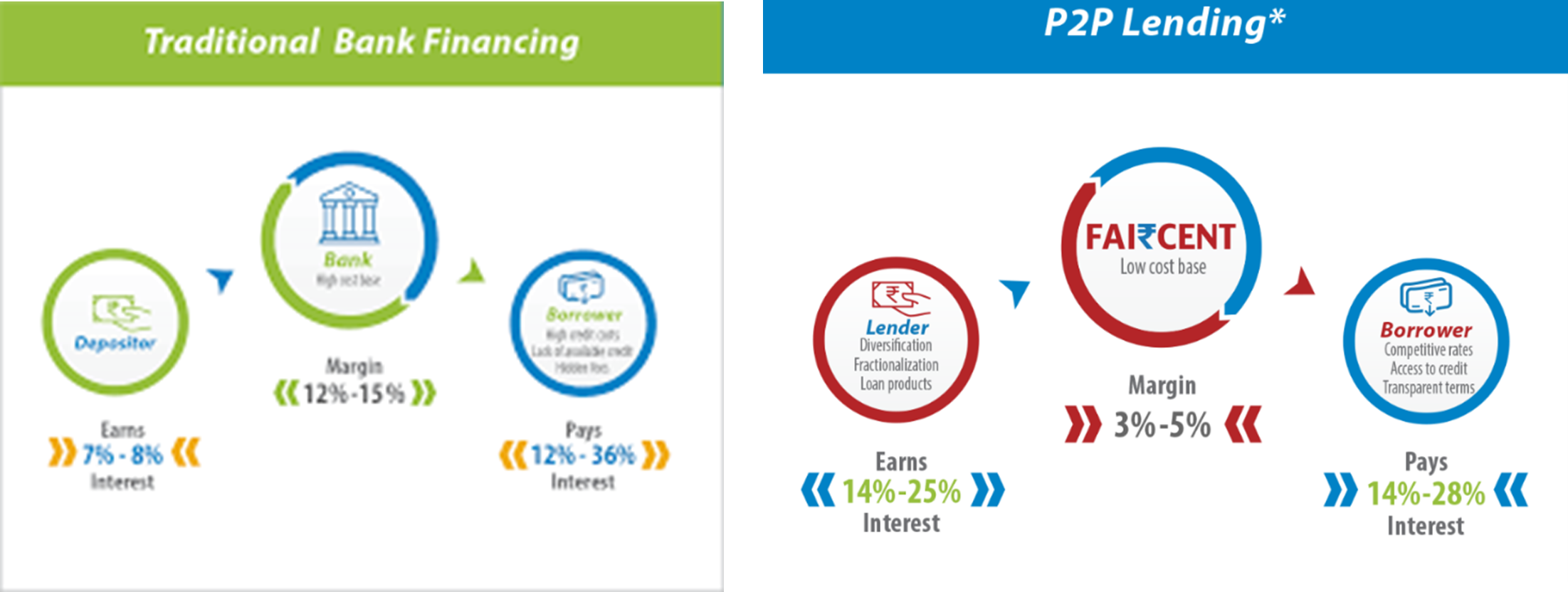

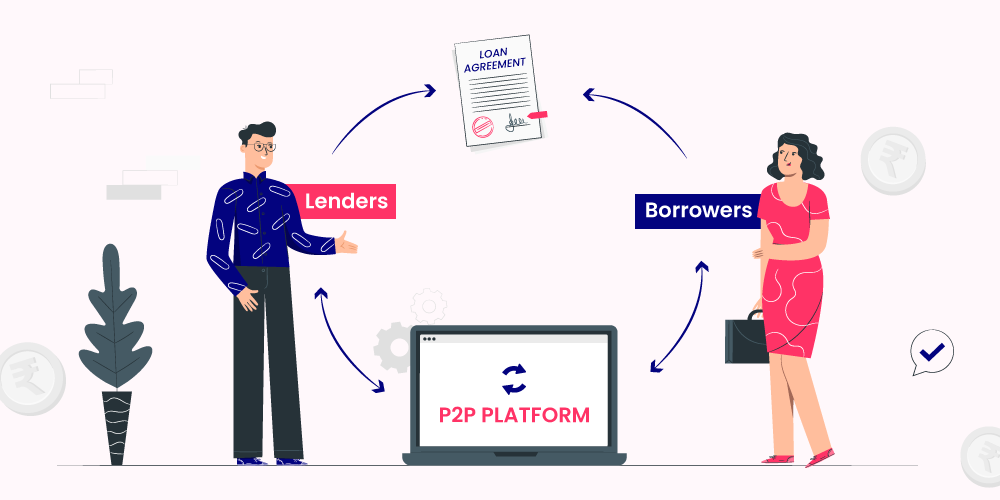

Faircent p2p offers borrowers and lenders a virtual marketplace where they may communicate directly without going through traditional financial intermediaries like banks, which have grown to be so big in today’s world that they impose strict terms and conditions on both borrower and lender.

As an NBFC-P2P, Faircent peer to peer lending or Faircent p2p is the first peer-to-peer lending platform in India to receive a Certificate of Registration (CoR) from the Reserve Bank of India (RBI).

Faircent peer to peer lending helps you reduce the massive profit margins that banks and other financial institutions make on your transactions. Because of our business strategy, we can cut institutional costs to a minimum and pass these savings through to you.

Therefore, Faircent offers the best rates whether you’re a lender or a borrower. We know that every percent matters!

Register as Individuals Start earning on your investments Click Here

What is P2P lending?

Moreover, Reserve Bank of India (RBI), which enables lending and borrowing of funds without a financial institution’s participation. As a result that it is an online portal, P2P Lending typically has lower operational costs than traditional banks. Peer-to-Peer a new form of debt financing termed peer lending is controlled by institutions or banks. As a result, lenders can increase their earnings and borrowers can borrow the money at lower interest rates.

Before After

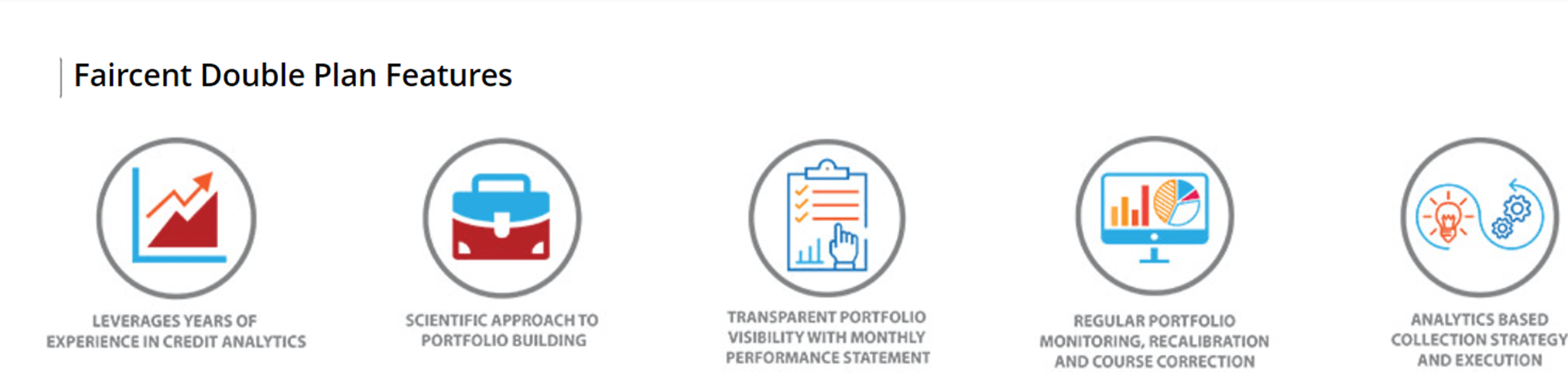

What is Faircent Double?

With Faircent Double, lenders will have an option in investments that will allow them to maintain the liquidity of the funds while earning stable returns. However, interested lenders combine their funds and allow Faircent p2p permission to use them to offer borrowers who, as according Faircent’s algorithms, have the ability to repay loans with cumulative returns of up to 12% p.a. a range of loans and loan packages.

Register as Lender to make Money Click Here

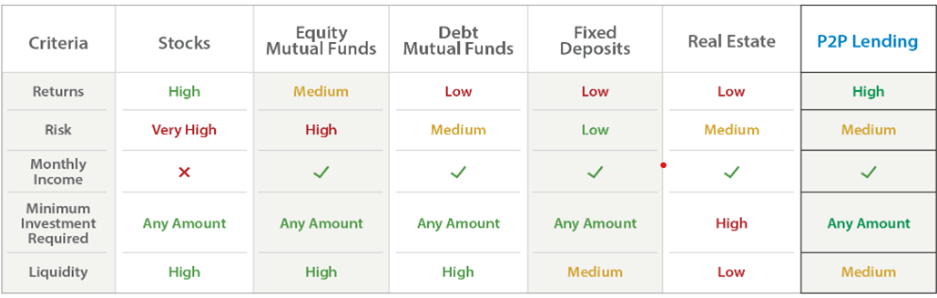

Analyze HOW IT Performs better OTHER Investment Strategies?

Savings account annual rates are 3.5%, PPF and NSC yields are 7.6%, and FD returns are 7-8%. These returns are below or equal to the average annual rate of inflation of 6.07%. Since stock markets are quite unpredictable and need consumers with high risk appetites, real estate demands very heavy investment, while mutual funds requires a long investments in order to generate significant returns.

Invest in Faircent P2P lending for high returns whether you’re looking for the best method to manage your future financial needs. Moreover, as of October 4th, 2017, the Reserve Bank of India opted to regulate the P2P lending industry. It also created a new class of NBFC (NBFC-P2P), offering P2P lending more credibility as an investment platform. Individuals or Institution or HUF can become lender by doing registration on faircent p2p lending review & earn handsome interest on their investments.

Follow the link for Lender HUF registration Click Here

P2P leading in comparison with other investments option:

Awards & Recognitions of Faircent P2P

India and the rest of the globe are aware of Faircent p2p incredible potential as a P2P lending platform.

What is Faircent P2P Lending?

A first NBFC-P2P platform registered in India, Faircent p2p, has been in use for more than 5 years. Faircent P2P Lending offers P2P lending, a new asset class that enables investors to earn high returns and that too month-over-month. With the help of reliable investors and management.

Follow the link for Lender HUF registration Click Here

Faircent P2P Investors

Faircent p2p lending review is financed by investors who just get our firm’ complexity, appreciate our vision, and have a wealth of previous business development experience.

Register as Individuals Start earning on your investments Click Here

Disclaimer

The Internet and various social media platforms were used to gather all of the information in this article. Therefore, we don’t guarantee that all the information is entirely (100%) accurate. Get in touch with us for any kind of issue.

Do Share your thoughts via comments