CA NEW SCHEME 2023-CA NEW SYLLABUS 2023

CA NEW SYLLABUS 2023:

About Chartered Accountant (CA)

A chartered accountant (CA) in India is a professional who has passed a series of exams and has met certain requirements set by the Institute of Chartered Accountants of India (ICAI). They are experts in accounting, auditing, and tax laws. They can help businesses and individuals with financial planning, tax filing, and compliance with government regulations. CAs also play a vital role in the auditing and assurance of financial statements of companies and other organizations. They have a strong understanding of accounting principles and regulations and use this knowledge to provide valuable advice to their clients. They are introducing CA NEW SYLLABUS 2023.

Institute of Chartered Accountants of India

ICAI stands for Institute of Chartered Accountants of India. It is a professional body that sets standards and provides education and training for people who want to become chartered accountants in India. Chartered accountants are experts in accounting and finance, and they help businesses and individuals manage their financial affairs. ICAI also monitors the work of chartered accountants to make sure they are following ethical and professional standards. In short, ICAI is an organization responsible for training and governing the profession of Chartered Accountancy in India.

CA NEW SCHEME 2023 of Education & Training for Chartered Accountant (CA)

The ICAI has recently announced a CA NEW SCHEME 2023 that will be implemented soon. The new scheme of education includes some modifications to the three stages of the CA Course and the practical course of three years.

Prior to this, ICAI revised the CA syllabus in the year 2017 where CA Foundation, CA Intermediate, and CA Final new course syllabus was launched.

The CA NEW SCHEME 2023 Some of the subjects at the three levels are combined while others are dropped. Additionally, under the new system in the new syllabus, the articleship period for CA decreases from 3 years to two years.

The features of this CA NEW SYLLABUS 2023 are explained below:

1. To build global-ready chartered accountants by equipping

-

- To develop globally ready chartered accountants by providing them with the necessary abilities.

- With the exception of country-specific examinations, there is a common curriculum for both domestic and international students.

- Training in Virtual Soft Skills and Information Technology

- Candidates residing outside India may receive Practical Training from approved Members of Accounting Bodies recognized by the International Federation of Accountants (IFAC)

2. Numbers of Level

As in the current structure, there would be three levels: Foundation, Intermediate, and Final.

3. Number of Papers

-

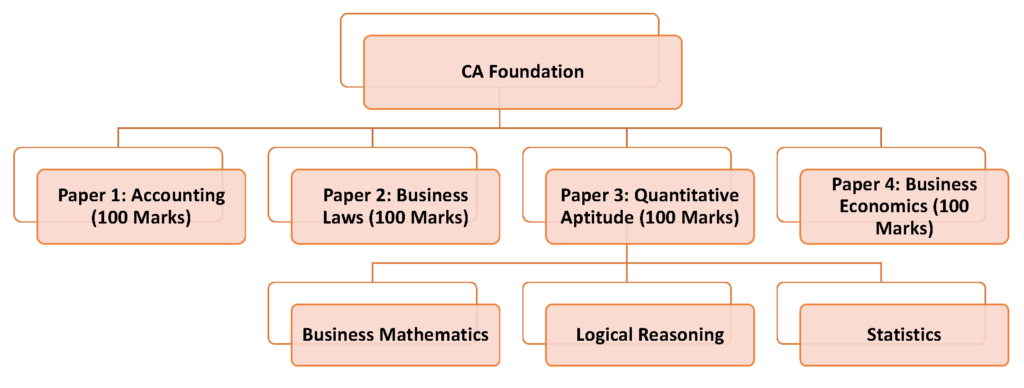

- Foundation level – 4 Papers

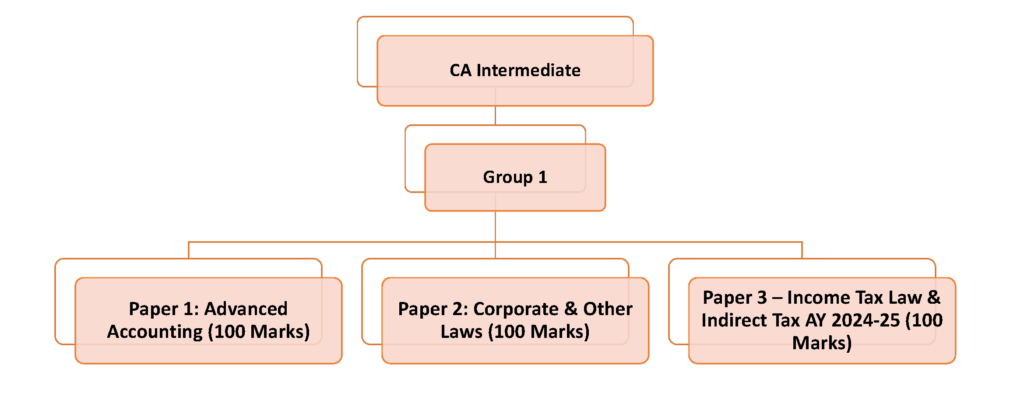

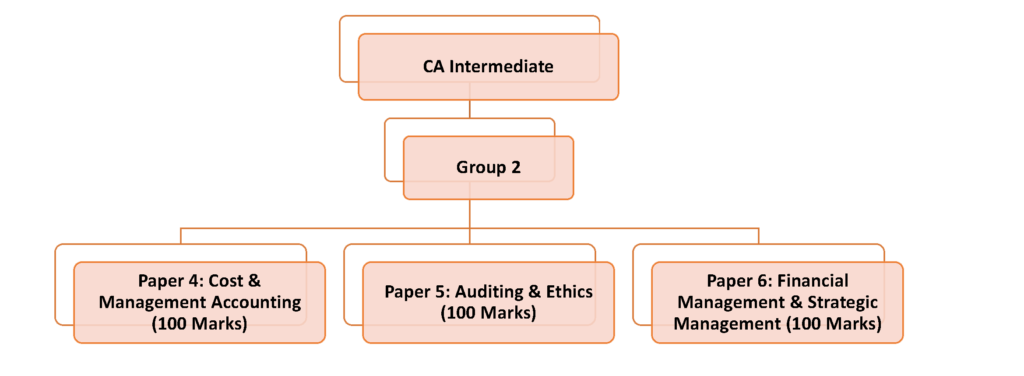

- Intermediate Level – 6 Papers (2 groups of 3 papers each)

- 4 Self-paced Learning Modules

- Final Level – 6 papers (2 groups of 3 papers each)

Note: Ethics and Information Technology would be integrated with the curriculum of subjects at the Final Level.

4. Introduction of Self-Paced Online Modules

-

- Four self-paced online learning modules covering various topics are being developed.

- After passing the intermediate level, students can learn and certify the modules at their own leisure.

5. Revalidation

Foundation

The validity of Registration is for 4 years. No Revalidation.

Intermediate

The validity of Registration is for 5 years. Revalidation is allowed, thereafter, once.

Final

The validity of Registration is for 10 years. Revalidation is allowed, thereafter.

6. Pattern of Assessment

Foundation level: Partly subjective & partly objective

Intermediate level:

1. Closed book examination

2. Case scenario/study-based MCQs account for 30% of the evaluation, while descriptive questions account for 70%.

Final level:

1. Open book/restricted open book pattern for all papers

2. 30% of the assessment is done by means of MCQs based on case scenarios or studies and 70% with the help of descriptive questions.

3. Mandatory Multi-disciplinary case study Paper.

7.CA NEW SYLLABUS: Eligibility for appearing at different levels of examination

Foundation

1. After completion of Four Months Study Period and

2. After appearing in Class XII

Intermediate

After completing eight months of studies Students can register with Foundation Route and Direct Entry Route.

Final

1. After passing both groups of Intermediate Exam

2. Successful completion of two years of practical training.

3. Passing and completing of Four Self-Paced Learning Modules,

4. Successful completion of the Management and Communication skills (MCS) and Advanced ITT (second stage)

5. After six months, after two years of Practical Training is complete and all courses are completed in the manner mentioned above, take the final exam.

8.CA NEW SYLLABUS: Passing Criteria

Foundation

50% for the paper (with 25 percent negative marking for every wrong answer in MCQs of papers 3 and 4).

Intermediate & Final

40% marks for each individual exam as well as 50% marks aggregated to pass the Group, with 25 percent negative marks (for incorrect answers to MCQ-related questions).

Exemption: Candidates who are granted exemption from any paper must complete the remaining exams within the next three attempts. The exemption is available with a passing mark of 50% for every paper (Applicable for Final and Intermediate Groupwise exams)

9. Intermediate Exit Route

Students who do not pass the Final Level Examination may apply for Business Accounting Associate (BAA) in the event that they meet the prescribed requirements.

10. Practical Training

-

- Practical and seamless instruction for two years

- Practical Training is able to be started following the completion of both the Examiners from Intermediate groups (for students who have completed the Direct Entry Route and Foundation) and the completion the IT Training and the Orientation course.

- Exam-free time, therefore 12 days of leave throughout the year is a requirement.

- Option to attend Industrial Training from 9 months to one year (in the final phase of training in the field)

- 100 percent increase in the current stipend being paid to the assistants to articles.

11. Soft Skill & Information Technology Training

-

- ITT and Orientation Course (first stage) to be completed prior to the beginning of the practical instruction.

- Management and Communication abilities (MCS) as well as Advanced ITT (second stage) to be completed throughout The Practical training period or thereafter but must be completed prior to appearing for Final Exam.

- Training will mix physical and virtual modes.

12. Requirement of COP

-

- One year of post-qualification experience at a CA firm that is required by Members who apply for Certificates of Practice at any point in the.

- One year of post-qualification experience in work is not applicable to a member who has been employed for at least one year in the company of another chartered accountant in the immediate preceding five years preceding the date of the application.

Papers Covered at Different level

Self-Placed Online Modules

Set A

Corporate and Economic Laws (100 Marks) (Compulsory Online Module)

Set B

Strategic Cost and Performance Management (100 Marks) (Compulsory Online Module)

Set C

(Optional Online Module-Specialization Elective)

Subjects that are globally relevant for positioning CA Qualification as a global qualification.

(Students have to choose any one module)

- Risk Management

- Sustainable Development and Sustainability Reporting

- Public Finance and Government Accounting

- The Insolvency and Bankruptcy Code, 2016

- International Taxation

- The Arbitration and Conciliation Act, 1996

- Forensic Accounting

- Valuation

- Financial Services and Capital Markets

- Forex and Treasury Management

Set D

Towards developing inheritance traits of CA Students & incorporating Multi-Disciplinary approach envisaged in NEP 2020

(Students have to choose anyone module)

- The Constitution of India & Art of Advocacy

- Psychology & Philosophy

- Entrepreneurship & Start-Up Ecosystem

- Digital Ecosystem and Controls

A student must undergo online education within Economic Laws [SET A] and Strategic Cost Management and Performance Evaluation [SET Bobligatorily. In addition, he must select one of the modules from SET C and SET D.

Final Course – Total 6 Papers

- Paper 1: Financial Reporting (100 marks)

- Paper 2: Advanced Financial Management (100 marks)

- Paper 3: Advanced Auditing, Assurance and Professional Ethics (100 marks)

- Paper 4: Direct Tax Laws and International Taxation (100 marks)

- Paper 5: Indirect Tax Laws (100 marks)

- Paper 6: Integrated Business Solutions (Multi-disciplinary case study with Strategic Management) (100 marks)

Overall Scheme of Education & Training: CA NEW SCHEME 2023

Foundation Course Route

According to the Foundation Course Route, a student who is a Class X completed student can enroll at the Board of Studies (BOS) of the Institute for the Foundation Course. The procedure is as follows:

- Complete the registration and 4 months of formal training for the Foundation Course.

- Appear for the Foundation examination after appearing in the Class XII examination.

- Qualify Foundation Examination.

- Join the Intermediate course only after having passed the Class XII exam and foundation exam

- Complete eight months of the educational theory in the intermediate course.

- Pass both Groups of the Intermediate Examination.

- Complete the Integrated Course covering Information Technology and Soft Skills (ICITSS) prior to the start of the training in the real world.

- Register for 2 years of practical Training after passing both Groups of Intermediate Examination and having completed the Integrated Training in Information Technology and Soft Skills (ICITSS).

- Register for the final Course after completing both Groups of the Intermediate Course.

- Complete the Self-Paced Online Courses in four parts and pass the online test (marks are, however, not used to determine aggregate).

- Complete the Advanced ICITSS exam in the Practical Training period or thereafter prior to taking the final examination.

- Complete Practical Training.

- Attend the final examination after six months after the close of the two-year practicum period.

- You must be able to pass both groups of the Final exam

- Apply for Membership.

- Become a Member.

A Certificate of Practice can obtain at any time after having completed one year of post-qualification work within a CA firm.

Note: Students can choose to earn a BAA Certificate after passing both exams of the Intermediate level and completing 2 years of practical training, the MCS or Advanced IT Course as well as successfully completing self-paced online courses by paying the cost. The certificate will automatically be and be canceled when you pass The Final Examination.

Direct Entry Route

As in the CA NEW SCHEME 2023, it is proposed to allow Commerce Graduates/Post-Graduates (with minimum 55% marks) or Other Graduates/Post-Graduates (with minimum 60% marks) to register directly for Intermediate Course without writing the foundation examination. The following steps are mandatory for those who are qualified Graduates and Post Graduates in this manner:

- Join BOS. BOS in order to enroll for their Intermediate Course (provisional registration permitted to Postgraduates and final year students).

- Complete 8 months of theoretical training in the Intermediate Course (provisionally registered students may finish the eight-month studying period in the last year of graduation or post-completion).

- Attend and pass both Groups of the Intermediate Examination.

- Complete the Integrated Course covering Information Technology and Soft Skills (ICITSS) prior to beginning the training in the real world.

- Apply for two years of Practical Training following passing both Groups of the Intermediate Examination and having completed an ICITSS.

- Register for the final Course after completing both Groups of the Intermediate Course.

- You must pass both groups of the Final test.

- Apply for Membership.

- Become a Member.

A Certificate of Practice can obtain at any time after having completed one year of post-qualification work within a CA firm.

Note 1

Candidates who have passed the Intermediate exam of the Institute of Company Secretaries of India or Institute of Cost Accountants of India are also able to directly sign up for the intermediate course. The same steps (with an exception for the provisional registration) are also applicable to those who have passed the examination.

Note 2

Students can choose to earn a BAA Certificate after passing both exams of the Intermediate level after completing 2 years of practical training and MCS Advanced IT Training and passing self-paced online modules by paying the cost. The certificate will automatically be removed or canceled upon passing an exam called the Final Examination.

International Curriculum: Building Global Ready CAs

- The International Curriculum of ICAI can help achieve the objective of the Government to promote the internationalization of higher education, as stipulated by the New Education Policy 2020, and to establish itself as a leader in the global professional accounting education field.

- Branding India and ICAI all over the world through the launch of the International Curriculum especially in countries those countries where no accounting professional exists or where the profession of accounting is in the beginning stage of development.

- the International Curriculum (ICU) of ICAI With its distinct features, envisions positioning the CA certification from ICAI as a globally recognized qualification to meet the growing demand for professionals in accounting outside India.

- The curriculum will be the same for both international and domestic students With the exception of documents that are specific to the country.

- A candidate who is residing outside India can pursue practical training in the presence of eligible members of Accounting Bodies outside India recognized by the International Federation of Accountants (IFAC)

- A curriculum for international students of ICAI to also encourage exports of accounting and educational services, as stipulated in the Indian Government’s “Action Plan for Champion Sectors in Service’.

- Virtual Soft Skills and Information Technology Training.

- With these features that incorporate the world’s most effective practices, ICAI strives to make sure that the structure is modern, up-to-date, and compatible with the demands of the market globally and in the domestic market.