Advanced GST Certificate Course by CA Raj K Agrawal

₹2,000.00

| Program | Pre-Recorded Videos |

|---|---|

| Device | Windows |

| No. of Lecture | 74 |

| Lecture Duration | 56 Hours |

| Language | Hinglish |

| Faculty | |

| Contains | Encrypted Video's, Video Player |

| Usage | Single Device |

| Certificate | Yes |

1. Classes available for Windows/Android/iOS.

2. Can be viewed only on any one device.

3. Views allowed are unlimited within the validity period.

4. To view videos on Windows Device, video player provided is required to be installed on your Laptop or Desktop with the help of the tutorial provided. Once installed encrypted videos can be accessed by using “Login ID” sent via email”.

5. On Windows internet is required for 1 or 2 seconds each time when video player is started, post that videos can be viewed offline.

6. On Android and iOS platforms you have the ability to both stream and download videos for offline viewing within the App.

7. If you buy from here you will get access to Windows Device only.

8. Incase you wish to get access on Mobile, buy directly from Android/iOS App – Study At Home – Learning App

Frequently Asked Questions (FAQs):

Q. What is an Advanced GST Certificate Course?

A. An Advanced GST Certificate Course is a training program that teaches you about the complex aspects of the Goods and Services Tax (GST) system in India. The course covers topics such as reverse charge mechanism, composition scheme, and input tax credit.

Q. Who is an Advanced GST Certificate Course for?

A. An Advanced GST Certificate Course is for anyone who wants to gain a deeper understanding of the GST system. The course is particularly beneficial for accountants, tax professionals, and business owners.

Q. What are the benefits of taking this Course?

A. There are many benefits to taking an Advanced GST Certificate Course. Some of the benefits include:

- Increased knowledge of the GST system

- Improved understanding of complex GST concepts

- Enhanced ability to comply with GST regulations

- Increased confidence in managing GST-related matters

Q. What are the requirements for taking this Course?

A. There are no specific requirements for taking this Course. However, some basic knowledge of GST is helpful.

Q: From where can I get more Skill Development Course like this?

A: You can get numerous Skill Development Courses like this course on Study At Home platform and enhance your skills while earning certificates.

Related

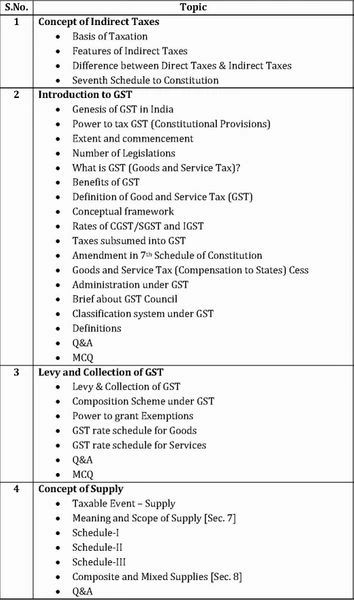

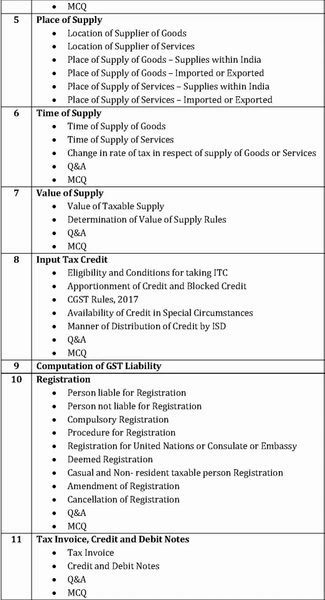

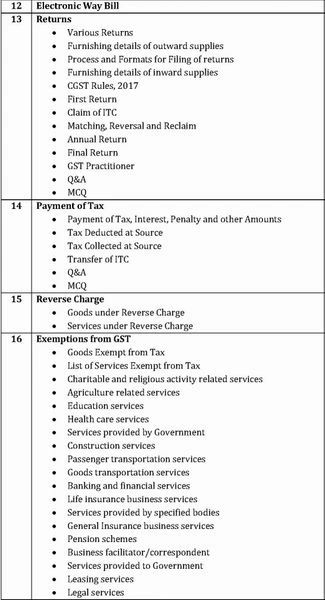

About Course

Embark on the journey to become a certified GST Expert with our comprehensive “Advanced GST Certificate Course” This program is carefully crafted to empower individuals with the knowledge and skills required to navigate the complex landscape of Goods and Services Tax (GST) with expertise.

Throughout this course, you’ll delve into the fundamental principles of GST, gaining a deep understanding of its structure, regulations, and implications for businesses. Learn how to interpret GST laws, handle compliance issues, and provide valuable insights to businesses seeking to adhere to GST guidelines.

The curriculum covers a range of topics, including GST registration, filing returns, input tax credit, and handling GST audits. Practical case studies and real-world scenarios enhance your learning experience, ensuring that you can apply your knowledge effectively in professional settings.

Upon successful completion of the course, you’ll receive a certification attesting to your expertise in GST. Whether you are a professional looking to enhance your skills or an entrepreneur aiming for in-depth GST knowledge, this course provides the tools and certification to elevate your proficiency and credibility in the field.

Join us on this transformative journey to become a certified GST Expert, equipped with the skills and confidence to navigate the complexities of GST seamlessly. Elevate your career and make a significant impact in the realm of taxation with this specialized certificate course.

Related

About Faculty

CA Raj K Agrawal is a qualified Chartered Accountant, he qualified CA Final with AIR 27 and CA Foundation with AIR 29. After qualifying CA, his passion for teaching led him to embark on a teaching career immediately. Because of the way he teaches and his rank in the CA exam, CA Raj K Agrawal became well-known for teaching CA, CS and CMA students in different parts of India, from the north to the south. CA Raj K Agrawal has taught over 200,000 students. His main goal is to help students understand both theoretical and practical aspects of their subjects to ensure success in exams and the attainment of professional expertise. He is also the author of many best-selling books published by most renewed publishers of India.

He has received numerous awards and accolades for his exemplary contributions. Notable recognitions include the National Startup Award 2021 from Hon’ble Prime Minister, Asian Education Award, the Global Teaching Excellence Award, Edupreneur of the Year Award and India’s 40 under 40 brightest business leaders.

Related

Demo

Related

5 reviews for Advanced GST Certificate Course by CA Raj K Agrawal

You may also like…

-

Indian Accounting Standards (Ind AS)

₹2,000.00

Related products

-

CS Executive (2022 Syllabus) Module II – All Subjects Combo

₹26,000.00₹6,500.00 -

Paper 3 – Fundamentals of Business Mathematics & Statistics by CA Raj K Agrawal

₹6,000.00₹1,500.00

Ayush –

It was an excellent learning experience, this course is value for money

Rohan Singh –

Yeh course GST ka complex management asaan karne mein madad karta hai. Course material aur teaching methodology bahut acche hain, isliye yeh course sabhi ke liye zaroori hai.

Neel Sharma –

I have been able to leverage his expertise and knowledge. I am grateful for the support and flexibility provided by study at home. I would definitely suggest this course to other.🙌🙌

Aarav Sharma –

This course really made GST simpler for me and boosted my confidence in dealing with its complexities. Highly recommend it!

Mohan Bist –

This certificate course provides good knowledge of goods and services tax which is very helpful and adds good value to your knowledge.