Filter by price

Video Lectures

Products

-

Income Tax Return Filing Course

Rated 5.00 out of 5₹600.00

Income Tax Return Filing Course

Rated 5.00 out of 5₹600.00 -

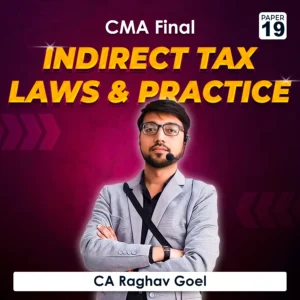

Paper 19 – Indirect Tax Laws and Practice (CMA Final Group IV) by CA Raghav Goel

Rated 0 out of 5

Paper 19 – Indirect Tax Laws and Practice (CMA Final Group IV) by CA Raghav Goel

Rated 0 out of 5₹20,000.00₹5,000.00 -

CA Intermediate Both Group I & II – All Subjects Combo

Rated 5.00 out of 5₹14,500.00

CA Intermediate Both Group I & II – All Subjects Combo

Rated 5.00 out of 5₹14,500.00 -

CA Intermediate Group I – All Subjects Combo

Rated 5.00 out of 5₹7,000.00

CA Intermediate Group I – All Subjects Combo

Rated 5.00 out of 5₹7,000.00 -

Practical GST Return Filing Course

Rated 5.00 out of 5₹600.00

Practical GST Return Filing Course

Rated 5.00 out of 5₹600.00

Showing all 14 results

-

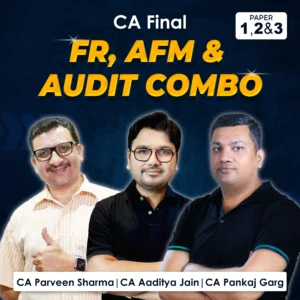

Paper 1 – Financial Reporting (CA Final Group I New Syllabus) by CA Parveen Sharma

₹14,900.00 – ₹20,000.00 -

Paper 1 – Financial Reporting (CA Final Group I New Syllabus) by CA Parveen Jindal

₹13,600.00 – ₹18,700.00 -

Paper 2 – Advanced Financial Management (CA Final Group I New Syllabus) by CA Aaditya Jain

₹20,000.00 – ₹21,000.00 -

Paper 2 – Advanced Financial Management (CA Final Group I New Syllabus) by CFA Sanjay Saraf

₹15,100.00 – ₹22,100.00